Wayve Secures $1Billion from SoftBank, Microsoft, and NVIDIA to Build AI for Self-Driving Cars

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person

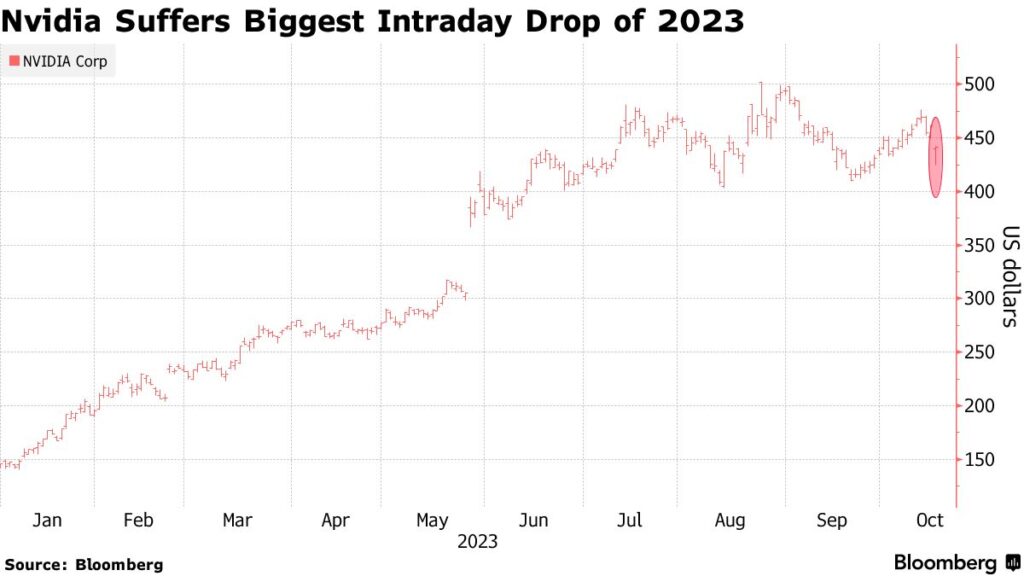

In a significant blow to the semiconductor industry, chip stocks experienced a sharp decline on Tuesday following the United States’ announcement of sweeping updates to export curbs aimed at restricting China’s access to advanced computer chips. The PHLX Semiconductor Sector index, a key indicator comprising 30 chip stocks, was poised to wipe out approximately $73 billion in combined market value.

The newly imposed restrictions specifically target Nvidia Corp., a major player in the semiconductor market. The affected chips include Nvidia’s A800 and H800 models, which were designed for the Chinese market. The updated rules mandate that companies notify the US government before selling chips that fall below the controlled threshold, a move intended to tighten control over the export of advanced semiconductor technology.

A senior US official highlighted the significance of these curbs, emphasizing the potential risks associated with even slightly inferior chips that could be employed in artificial intelligence (AI) and supercomputing applications. The latest measures reflect a broader effort by the US to maintain control over the export of technologies with dual-use capabilities.

Nvidia responded to the development, with a company spokesperson stating that they are committed to complying with all applicable regulations while serving their customers. Despite the challenges posed by the new restrictions, Nvidia remains confident due to the robust global demand for its products and anticipates minimal impact on its overall results.

Also Read: Baidu Says Its AI as Good as ChatGPT in Big Claim for China

However, industry analysts suggest a more cautious outlook. Kunjan Sobhani, an analyst for Bloomberg Intelligence, noted that while the immediate impact on Nvidia’s estimates might not be substantial, the long-term prospects of the company could be at risk. Sobhani highlighted the possibility of a decline in Nvidia’s future sales, indicating that a recent surge in orders from large Chinese customers might have been driven by stockpiling of 800-series chips in anticipation of such restrictions.

Investors responded swiftly to the news, causing Nvidia shares to plummet by as much as 7.8% on Tuesday. This marked the most significant intraday fall for the company since December, reflecting the market’s concern over the potential ramifications of the tightened export controls on Nvidia’s business operations.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

On Wednesday, Infosys and NVIDIA declared that they have intensified their strategic partnership to support businesses all over the world in using generative AI tools and applications to increase productivity.

The expanded collaboration will provide Infosys Topaz, an AI-first suite of services, solutions, as well as platforms that enhance company value by leveraging generative artificial intelligence technologies, with access to the NVIDIA AI Enterprise network of models, runtimes, tools, plus GPU systems. Infosys will develop products that clients can use to quickly incorporate generative AI into their operations through the integration, the firm stated in its regulatory submission.

Furthermore, Infosys announced plans to establish an NVIDIA Excellence Centre, where it would educate and certify 50,000 of its staff members on NVIDIA artificial intelligence (AI) technology to offer generative artificial intelligence (AI) services to its extensive network of clients across sectors.

“Infosys is transforming into an AI-first company to better provide AI-based services to our clients worldwide. Our clients are also looking at complex AI use cases that can drive significant business value across their entire value chain,” said Nandan Nilekani, Co-founder and Chairman, Infosys.

“Infosys Topaz offerings and solutions are complementary to NVIDIA’s core stack. By combining our strengths and training 50,000 of our workforce on NVIDIA AI technology, we are creating end-to-end industry leading AI solutions that will help enterprises on their journey to become AI-first,” he added.

financialexpress.com

Integrated Full-Stack NVIDIA Enables Sophisticated Infosys Services To foster creativity across all of its business processes, Infosys leverages the full-stack NVIDIA generative artificial intelligence platform, which includes enterprise-grade software as well as hardware. Infosys also assists clients in developing generative artificial intelligence applications for company operations, revenue, and advertising.

The NVIDIA AI Enterprise network is swiftly scaling up to deliver the generative AI platform. Together with Infosys, NVIDIA is going to create a skilled workforce to assist startups in using this platform to develop unique applications and services.

Also Read: OpenAI Releases Third Version of AI Image Creator DALL-E in October

Infosys is currently developing several AI-first business solutions across sectors using NVIDIA AI Enterprise systems, models with prior training, and toolkits, such as the NVIDIA NeMo LLM structure, NVIDIA Metropolis for computer vision, including NVIDIA Riva for speech Intelligence.

combining the Infosys Video Analytics solution with NVIDIA Metropolis, which uses the capabilities of computer vision to tackle a variety of difficulties facing the retail sector, which includes the creation of seamless purchasing experiences.

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person

Tuesday saw Nvidia Corp (NVDA.O) reach a trillion-dollar market valuation as shares rose following a strong earnings report that made Wall Street reevaluate the chipmaker’s potential bonanza from artificial intelligence growth.

The $1 trillion valuation of Nvidia places it behind Apple, Microsoft, Alphabet, and Amazon as the fifth most valuable U.S. firm. The gaming chip manufacturer Nvidia recently made a shift to the data center industry.

When gaming and cloud adoption exploded during the pandemic and cryptocurrency aficionados began using the company’s chips to mine coins, the company’s business grew quickly. In the fiscal year that concluded on January 29, the company’s data center chip division generated more than 50% of its sales.

Also Read: Chip giant Nvidia nears trillion-dollar status on AI bet

This year, generative AI has become popularised by the ChatGPT chatbot, which went viral. The technology generates new content, such as poems, photos, and even computer code, using enormous amounts of pre-existing data.

The two major companies in the field, Microsoft and Alphabet Google think that generative AI will revolutionize the way that work is done. As they compete to rule the market, the two have rushed to incorporate technology into their internet search engines and efficiency programs.

By 2030, according to Goldman Sachs analysts, American investment in AI may account for close to 1% of the nation’s GDP. Powerful chips known as graphics processing units (GPUs) are used in huge computers that process data and power generative artificial intelligence. Analysts estimate that around 80% of GPUs are made by Nvidia.

The specialized type of math required for AI computation can be handled very effectively by GPUs. Generic central processing units, on the other hand, are less effective in handling a wider range of computing activities.

As an illustration, thousands of Nvidia GPUs were used to build OpenAI’s ChatGPT. Elon Musk, the CEO of Tesla, also purchased GPUs from Nvidia for his AI business, according to a Financial Times report from April. Advanced Micro Devices and internal AI processors produced by businesses like Amazon, Google, and Meta Platforms are among Nvidia’s key rivals.

Also Read: Grab co-founder Tan Hooi Ling to step down from operational roles

Nvidia is a leading manufacturer of GPUs, which are widely used in gaming, data centers, and AI applications. The demand for GPUs has been increasing as more industries and technologies rely on parallel processing capabilities for tasks such as AI training, deep learning, and high-performance computing.

Nvidia has been at the forefront of the AI boom, leveraging its GPUs to accelerate AI and machine learning workloads. The company’s GPUs are particularly well-suited for training deep neural networks, which require intensive computational power. With the rapid growth of AI applications across industries, Nvidia’s GPUs have become a crucial component of AI infrastructure.

·

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

In among of the biggest single-day surges in value around a U.S. stock, Nvidia Corporation’s shares soared 24 percent following its excellent income prediction revelation on Thursday that Wall Street had not yet priced in the AI technology’s ability to change the world.

The rise surpassed doubled the price of the stock during the year and brought the overall market worth of the chip designer up to over 939 billion dollars, which is a rise of roughly 184 billion dollars.

Thus, Nvidia is now almost two times as big as TSMC, the second-biggest chip manufacturer in Taiwan. It is only behind Apple Inc., Alphabet Inc., Microsoft Corp., as well as Amazon.com Inc. in terms of US market worth.

Also Read: OpenAI’s ChatGPT app tops 500K downloads in just 6 days

The positive news also prompted a surge in the chip manufacturing sector and for businesses with a strong focus on artificial intelligence, propelling share markets from Japan to Europe. While the stock of Advanced Micro Devices, Inc. closed 11 percent better, the other Tech Giant companies ended in the range of 0.6 percent and 3.8 percent higher in the US.

consequently, the business’s strength in the marketplace for the processors that power ChatGPT along with many other services like it, experts hurried to increase their price objectives on Nvidia stock, including 27 raising their opinion that all paths in AI led to it.

Over the past twelve months, the average price goal has nearly doubled. Nvidia’s worth is expected to be near that of Alphabet under the maximum scenario, a 644.80 dollar price goal from Elazar Advisors, which values the company at 1.59 trillion dollars.

“In the 15+ years we have been doing this job, we have never seen a guide like the one Nvidia just put up with the second-quarter outlook that was by all accounts cosmological, and which annihilated expectations,” Stacy Rasgon of Bernstein said.

Source: money.usnews.com

The 5th most valuable US firm, Nvidia, forecast a quarterly profit on Wednesday that was over 50 greater than the usual Wall Street prediction & stated that it might have a greater number of AI chips available in the second half to satisfy an increase in consumption.

As generative artificial intelligence is included in each good and service, CEO Jensen Huang estimated that a total of one trillion dollars of present equipment in data centers would need to be substituted with AI chips.

The outcomes are encouraging for giant Tech firms, who have moved their attention to artificial Intelligence in the belief that the technology can boost need at a time when their key revenue generators, cloud computing as well as digital advertising, are experiencing force from an economic downturn.

Also Read: Windows 11 finally gets native RAR support

According to several analysts, Nvidia’s outcomes demonstrate that the generative artificial intelligence surge may be the next major economic catalyst.

“We’re really just seeing the tip of the iceberg. This really could be another inflection point in technological history, such as the internal combustion engine – or the internet,” said Derren Nathan, head of equity analysis at Hargreaves Lansdown.

Source: money.usnews.com

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person