In a significant blow to the semiconductor industry, chip stocks experienced a sharp decline on Tuesday following the United States’ announcement of sweeping updates to export curbs aimed at restricting China’s access to advanced computer chips. The PHLX Semiconductor Sector index, a key indicator comprising 30 chip stocks, was poised to wipe out approximately $73 billion in combined market value.

The newly imposed restrictions specifically target Nvidia Corp., a major player in the semiconductor market. The affected chips include Nvidia’s A800 and H800 models, which were designed for the Chinese market. The updated rules mandate that companies notify the US government before selling chips that fall below the controlled threshold, a move intended to tighten control over the export of advanced semiconductor technology.

A senior US official highlighted the significance of these curbs, emphasizing the potential risks associated with even slightly inferior chips that could be employed in artificial intelligence (AI) and supercomputing applications. The latest measures reflect a broader effort by the US to maintain control over the export of technologies with dual-use capabilities.

Nvidia responded to the development, with a company spokesperson stating that they are committed to complying with all applicable regulations while serving their customers. Despite the challenges posed by the new restrictions, Nvidia remains confident due to the robust global demand for its products and anticipates minimal impact on its overall results.

Also Read: Baidu Says Its AI as Good as ChatGPT in Big Claim for China

However, industry analysts suggest a more cautious outlook. Kunjan Sobhani, an analyst for Bloomberg Intelligence, noted that while the immediate impact on Nvidia’s estimates might not be substantial, the long-term prospects of the company could be at risk. Sobhani highlighted the possibility of a decline in Nvidia’s future sales, indicating that a recent surge in orders from large Chinese customers might have been driven by stockpiling of 800-series chips in anticipation of such restrictions.

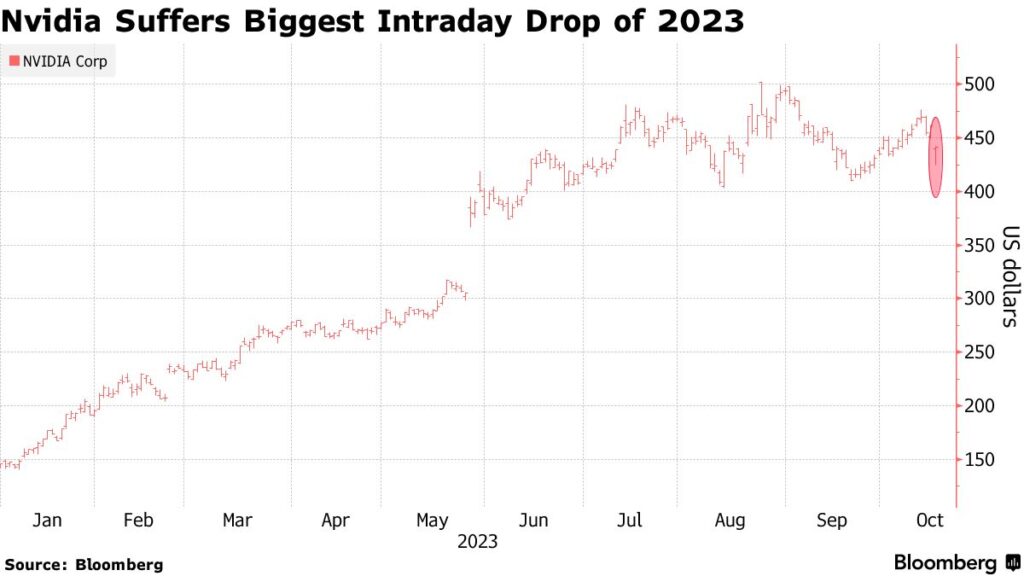

Investors responded swiftly to the news, causing Nvidia shares to plummet by as much as 7.8% on Tuesday. This marked the most significant intraday fall for the company since December, reflecting the market’s concern over the potential ramifications of the tightened export controls on Nvidia’s business operations.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.