The Department of Justice stated on Tuesday that Binance Holdings, the owner of the largest exchange for digital currencies around the globe, has entered a guilty plea to felony charges in the United States alleging that it had broken the Bank Secrecy Act along with other laws. The company also agreed to pay a penalty of $4.3 billion to end the inquiry.

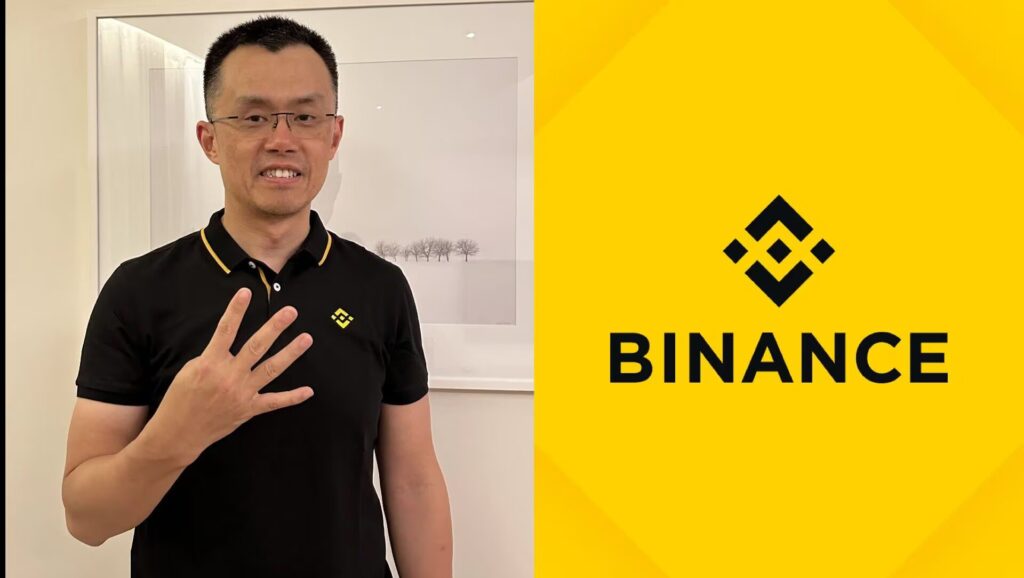

Furthermore, according to the Department of Justice, Binance founder Changpeng Zhao filed a guilty plea for violating the BSA by neglecting to run an efficient money laundering prevention programme. Zhao is no longer the organization’s chief executive officer.

“Binance became the world’s largest cryptocurrency exchange in part because of the crimes it committed — now it is paying one of the largest corporate penalties in U.S. history,” U.S. Attorney General Merrick Garland said in a statement. Garland alluded to the U.S. government’s prosecution of another cryptocurrency executive, FTX founder Sam Bankman-Fried, who a jury found guilty on seven counts of fraud and conspiracy earlier this month. “The message here should be clear: using new technology to break the law does not make you a disruptor, it makes you a criminal,” Garland said.

Binance's Deliberate Breaches Enabled Funds to go to Criminals

Image Source: coindesk.com

Treasury Secretary Janet Yellen stated in a statement that Binance’s deliberate breaches enabled funds to go to terrorists, and cybercriminals, including perpetrators of child abuse via its platform. Today’s significant fines and oversight to guarantee adherence to US laws and regulations represent a turning point for the digital currency market. Any organisation, wherever it may be, that wishes to profit from the American financial system must abide by the laws that protect us all against criminal activity, terrorist attacks, and foreign enemies.

According to the Department of Justice, Binance, which debuted in 2017, aimed to draw in large numbers of clients. The company needed to register as a financial services firm with the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) and put in place an efficient money laundering prevention project that was fairly created to avoid Binance being utilised or used for the purpose of money laundering since it catered to American consumers, said the Department of Justice

Court records claim that Binance needed to put in place appropriate safeguards and operations, such as thorough know-your-customer policies or regular transaction tracking, to stop the laundering of cash. Furthermore, according to the Department of Justice, Binance never submitted a report of suspicious activity (SAR) to FinCEN.

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person