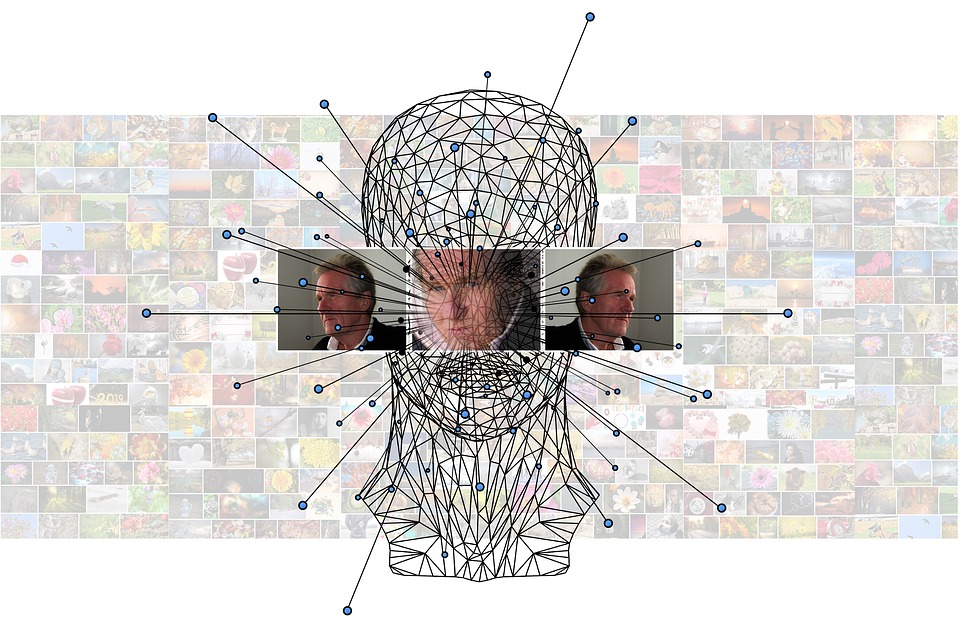

In today’s digital world, where everything is global and easily accessible to all, maintaining security and compliance seems to be the most difficult task for businesses. However, these regulations also create opportunities to save costs and increase efficiencies. By enabling identity verification for risk management, businesses can attain considerable benefits including enhanced customer services and identity theft protection.

The intelligent address verification checks enable the organizations to curb fraudsters and improve customer experiences with verified addresses. Businesses need to have document verification solutions integrated into the system to authenticate the identity and real address of a person.

Digitization has eliminated the boundaries between the real-life and digital identities of a person. With this increase in online activity, online businesses are under constant pressure. The pressure to comply with regulatory compliance designed to prevent identity theft, credit card frauds, and money laundering while providing satisfactory customer services and meeting business objectives. Online ID verification of customers help verify the identity of the customers through various means to mitigate the risk of financial fraud and cyberattacks.

Also Read: Gill Shwed : The Israeli Inventor & the Pioneer of the Cybersecurity

What is Identity Verification and What challenges does identity theft pose?

Identity verification is used to authenticate that a person is who they claim they are. For businesses, verifying the true identity of their clients is a critical aspect to establish trustful business relationships.

Despite the advent of superior technologies, fraudsters endure stealing data and conducting online fraud, which poses a great threat to the online business community. Both companies and customers suffer from these frauds. One of the challenges that threaten online businesses the most is a data breach.

Data breaches not only intimidate consumers financially but personally too. Cybercriminals exploit online data and sell it on the dark web, which is used to conduct fraud. On the other hand, the business also faces monetary loss. Their brand reputation and customer trust are largely damaged. Recovering from negative publicity, revenue, and customer loss, most of the time is impossible.

Identification can’t be ignored if corporations want to meet regulatory compliance, build customer trust, as well as brand reputation.

Also Read: Eugene Kaspersky : Russian Entrepreneur & Cybersecurity Expert

Ways online businesses can benefit from identity authentication

Increasing Operational Efficiencies

According to the USA Patriot Act, digital financial institutes are obliged to perform lengthy risk analysis. Identity verification technology helps integrate these policies into normal risk analysis procedures while making it efficient.

Preventing Identity Fraud

While identity fraud impacts businesses and customers, firms need to prevent identity fraud. The best way to do it is; to add stringent checks at the on-boarding process. This way bad actors wouldn’t be able to exploit markets, which is why knowing your customers while onboarding is necessary. If employed, online Identity verification can prove to be a good defensive tool against the fraudsters.

Also Read: Harald Hass- German Professor who coined the new Li-Fi technology

Eradicating False Chargeback Claims

For a business, a charge-back claim can cost a lot. Although there are some real charge-back claims but owing to identity theft and friendly charge-back frauds, businesses suffer a lot. Identity proofing can solve these problems by verifying the users at onboarding and during each transaction. By using identity proofing these fraudulent claims reduce to zero.

Enhancing Customer Services

With the availability of a large amount of data on each person online, customers expect institutions to protect their information and provide a seamless experience at the same time. Identity verification technology allows new accounts to be opened quickly, creating a frictionless experience for customers while protecting the integrity of the system.

Global Flexibility

Physical identity documents only offer a limited view of identity information that can’t be expanded to cover additional attributes. For example, during on-site onboarding, only the originality of the documents from the specific country can be checked. Digital authentication provides a flexible and scalable system that is capable of incorporating a greater richness of identity information.

Conclusion

The importance of digital identification goes beyond eliminating identity theft. It enhances customer services and plays a major role in the digitization of businesses. By adopting technology that verifies customers’ identity accurately and instantly, without compromising the security, digital businesses can enhance the customer experience as well as keeps bad actors out of the system.

Also Read: How John Cioffi Gave Life to the Internet Through the Broadband