Huawei’s Profit Increased Due to Taking Stake from Apple and Alibaba

In an impressive financial performance, Huawei Technologies Co. has reported a significant increase in profits, attributing its success to gaining market share from industry giants Apple Inc. and Alibaba Group Holding Ltd. The Chinese tech giant, known for its telecom devices and smartphones, has demonstrated remarkable flexibility and strategic acumen in dealing with the highly competitive tech landscape.

Strategic Expansion and Diversification

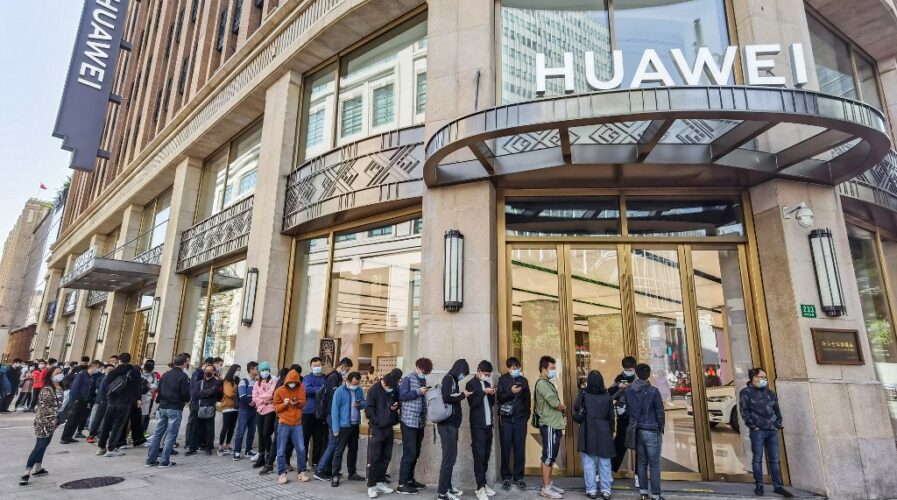

Image Source: techwireasia.com

Huawei’s recent financial disclosures highlight a year of strong growth, with the company successfully expanding into new markets and diversifying its product lineup. Analysts point to Huawei’s aggressive investments in research and development, especially in areas such as 5G technology, cloud computing and artificial intelligence, as key factors behind its recent achievements.

“By focusing on innovation and expanding our product offerings, we’ve been able to appeal to a wider audience and meet the evolving needs of our customers,” said a Huawei spokesperson. “Our ability to gain share from competitors like Apple and Alibaba is a testament to the strength of our technology and the dedication of our team.”

Gaining Ground in a Competitive Market

Despite facing significant challenges, including international investigations and trade sanctions, Huawei has managed to outperform expectations. Its success in gaining market share from Apple comes at a time when the smartphone market is highly saturated, with consumers looking for innovative features and value. Similarly, by offering competitive cloud services, Huawei is positioning itself as a strong rival to Alibaba in the cloud computing sector.

An industry analyst said, “Consumers and businesses alike are increasingly recognizing the quality and innovation that Huawei offers.” “This change in market dynamics is a clear indication that Huawei is not only surviving but thriving amid global competition.”

Looking Forward

As Huawei celebrates its recent successes, the company is also setting its sights on future growth opportunities. With an emphasis on developing cutting-edge technologies and expanding its global footprint, Huawei aims to consolidate its position as a leading player in the tech industry.

However, the path ahead is not without challenges. Huawei continues to navigate the complex geopolitical landscape and regulatory environment. Yet, with its latest financial performance, the company has sent a clear message: it is a force to be reckoned with, capable of competing with and even surpassing some of the biggest names in technology.

In conclusion, Huawei’s profit increase is more than a financial milestone; It is a declaration of the company’s enduring strength and strategic vision. As it continues to take market share from competitors like Apple and Alibaba, Huawei is reshaping not only its future but also the landscape of the global tech industry.