SoftBank’s Arm Plans to Launch AI Chips Next Year Amid Huge Global Demand

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

Seven years after SoftBank Group Corporation, the business’s owner, purchased Arm Holdings Plc for a price of 32 billion dollars, Arm Holdings obtained a 54.5 billion dollar estimate in its United States initial public offering (IPO) on Wednesday.

The estimated value of the company has dropped from the 64 billion dollars at which SoftBank last month purchased the 25 percent share it did not yet control in the business from the one hundred billion Vision Fund it oversees.

Even with this reduced cost, SoftBank still performs far better than its forty billion-dollar agreement to hand over Arm to Nvidia Corp, which it abandoned last year due to resistance from antitrust regulators.

According to the company’s announcement on Wednesday, Arm raised 4.87 billion dollars for SoftBank through the sale of 95.5 million stocks at a cost of 51 dollars per share, which was the top of its suggested range. The announcement of Arm’s valuing decision was originally made by Reuters.

On Thursday, shares of Arm are expected to begin trading in New York.

Numerous of Arm’s top clients have already agreed to participate as cornerstone investors in the company’s first public offering, which includes Apple, Alphabet, Nvidia, Advanced Micro Devices, Intel, as well as Samsung Electronics.

In an IPO, Arm secured enough support from financiers, according to Reuters, to guarantee at least the high end of the price spectrum between $47 and $51 per share, with the chance that the sale of shares would be priced above range.

Arm started advertising its IPO this week in an effort to persuade investors that it has growth opportunities outside of the mobile phone sector, which it now holds a 99 percent share of.

Also Read: Amazon, Alphabet, Microsoft, Meta Probed by Lawmakers on Use of AI ‘Ghost’ Staff

Arm’s sales have been flat since the global economy has been slowing down due to weak smartphone demand. In comparison to the previous year’s 2.7 billion dollars in revenue, the total for the 12 months ending in March was a price of $2.68 billion.

The cloud computing marketplace, of which Arm only holds a ten percent stake and thus has further room for growth, is anticipated to increase at a yearly pace of 17 percent through 2025, in part because of developments in artificial intelligence, Arm said interested parties in New York last Thursday. It is anticipated that the automobile market, which currently controls forty-one percent of global sales, will rise by 16 percent while the mobile sector is only anticipated to grow by six percent.

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person

After five quarters of revenue losses, SoftBank Group Corporation’s Vision Fund is set to earn a profit owing to a recovery driven by artificial intelligence which is increasing startup market valuations.

After suffering losses of 6.9 trillion dollars approximately $48 billion over the previous two years of operation at the Vision Fund investment subsidiary, the Japanese behemoth is battling to restore its foundation.

Based on the average of expert expectations, analysts anticipate a minor gain at the investment company for the three months ending in June, whereas SoftBank is expected to disclose a profit of about 73 billion dollars on Tuesday.The IPO (Initial Public Offering) of Arm Ltd. will determine if SoftBank owner Masayoshi Son can embark on the attack and look for new possibilities in business.

In a marketplace launch as early as September, his chip creator hopes to make a profit of a maximum of ten billion dollars at an estimated valuation of 60 to 70 billion dollars. If Arm were successful in achieving its fundraising goal, it would surpass Meta Platforms Inc. as well as Alibaba Group Holding Limited as the biggest technology debut ever.

The values of Arm’s competitors have increased as a result of their obsession with artificial intelligence. The valuation of NVIDIA Corporation has surpassed a trillion dollars this year, and the Nasdaq 100, a barometer for technology firms, had its greatest January-June result ever.

Also Read: Crypto stocks dip after bitcoin slumps to six-week low.

According to Kirk Boodry, a researcher at Astris Advisory, SoftBank provides investors with a means to participate in Arm as an artificial intelligence play before its debut.

“A further run once a public prospectus comes out would not be surprising at all,” he said.

“I’m not convinced we are completely out of the woods yet,” as July’s gains may turn out to be ephemeral while “tech seems priced for perfection (again),” Boodry said. Still, the bounce is “worth highlighting,” and Arm’s upside should provide support even if the Vision Fund looks weak, he said.

Source: finance.yahoo.com

According to Boodry’s estimation, the Vision Fund’s public holdings increased by around 1.1 billion dollars in the June quarter. The two companies that contributed the most, DoorDash Inc. along with Grab Holdings Ltd., had increases of 20 per cent and 14 per cent, respectively, throughout the time frame. Coupang Inc. had a 9 per cent increase. In the same time frame, SoftBank’s stocks increased 31 per cent, which was a three-year high.

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person

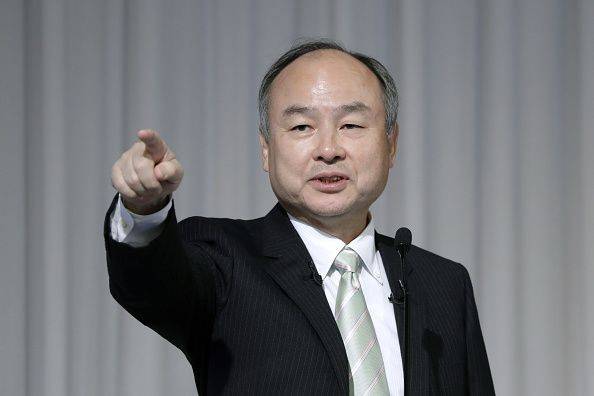

Masayoshi Son is a Korean-Japanese technology billionaire, financier, and investor. Masayoshi is the founder, chairman, and CEO of the Japanese holding corporation SoftBank, the Chairman of Arm Holdings, and the CEO of SoftBank Mobile.

Son has the recognition of having suffered the worst financial loss in history (about $70 billion during the dot-com crash of 2000), but as of September 2022, he is ranked 73rd on Forbes’ ranking of The World’s Billionaires 2022.

Early Life

Masayoshi Son was born into a second-generation Zainichi Korean family in Japan.

He was intelligent and inquisitive from an early age and was intrigued by America. He visited the US at the age of 16 years old for a short study abroad program. He subsequently decided to stop going to school in Japan and spend more time in the US. He made the decision to enroll at Holy Names University after high school.

He switched to the University of California after two years and studied computer science and economics there. During this time, he realized that microchips could help him become extremely wealthy and that computer technology will soon alter the business world. He decided to come up with a minimum of one business concept each day to maintain this spirit.

He had over 250 ideas toward the year-end, some of which would later result in enormous riches. In the year 1980, he earned a BA in economics.

Success Story

After earning his degree in 1980, he founded Unison in Oakland, California, which Kyocera eventually acquired. Despite his triumphs, Son left the USA. He established Softbank in Japan in 1981 with two part-time employees and a modest office. During that time, Softbank distributed software packages to Japanese customers.

Within one year, Softbank had already begun to diversify. In 1982, the company launched two monthly magazines concerning software and PCs. By the late 1980s, Softbank had developed an incredibly well-liked system that allowed customers all throughout Japan to select phone operators that offered the most affordable rates for local and long-distance calls.

But it was Softbank’s investment in Yahoo that gave it public attention. Yahoo’s largest shareholder, Softbank, established Yahoo Japan as its Japanese affiliate.

Between 1995-1998, Son staked $374 million on Yahoo, and at its height, his investment had generated a 50-fold profit. Son had made investments in several tech firms by the late 1990s, like Kozmo.com, SportsBrain, and More.com.

The dot-com crash

Son was particularly hard-hit by the dot-com crash in 2000. 99% of the value of Softbank’s shares was lost, according to experts, making it the largest single-person wealth loss in history. Although it was a devastating blow, Son was unflappable. He made an effort to restore his empire by starting a new company that offered broadband services in Japan.

Before being able to acquire Vodafone Japan in 2006 for almost $15 billion, SoftBank tried for years to break into the burgeoning mobile industry. At the time of its takeover, Vodafone Japan was right on the edge of bankruptcy, but Son nevertheless managed to position himself as a strong player in the Japanese phone industry.

Today, his company SoftBank Mobile is the most successful telecom company in Japan. In 2013, he acquired Sprint Nextel, an American telecoms holding company, for $22 billion in 2013. Sprint is currently the fourth-largest provider of wireless networks in the USA.

He also took another action during the 2000 dot-com crash that shaped his career for the following ten years. He invested over $30 million in Alibaba, a relatively unknown Chinese company at that time.

Alibaba has since grown to be among the most valuable businesses worldwide, and Softbank’s ownership has now reached an astounding $130 billion, representing a 2240x profit on his initial investment.

With the profits from Alibaba in hand, Softbank is now stepping up its attempts to invest in companies all around the world. It has started a $100 billion Vision Fund to guide the direction of global technological advancement.

Masayoshi Son is one of the most active investors and, through his company SoftBank, has the largest investments in firms like Yahoo! and Alibaba.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.