How Chips worth $1 created a Global Economic Crisis?

We have heard how the $450 billion semiconductor industry has hit a huge global crisis in this lockdown. Due to lack of production and strain in transportation and availability, the semiconductor industry is going through a big turmoil. But, the question is what exactly sparked this crisis affecting semiconductor companies across the world? The answer to this question is a $1 dollar chip called a display driver.

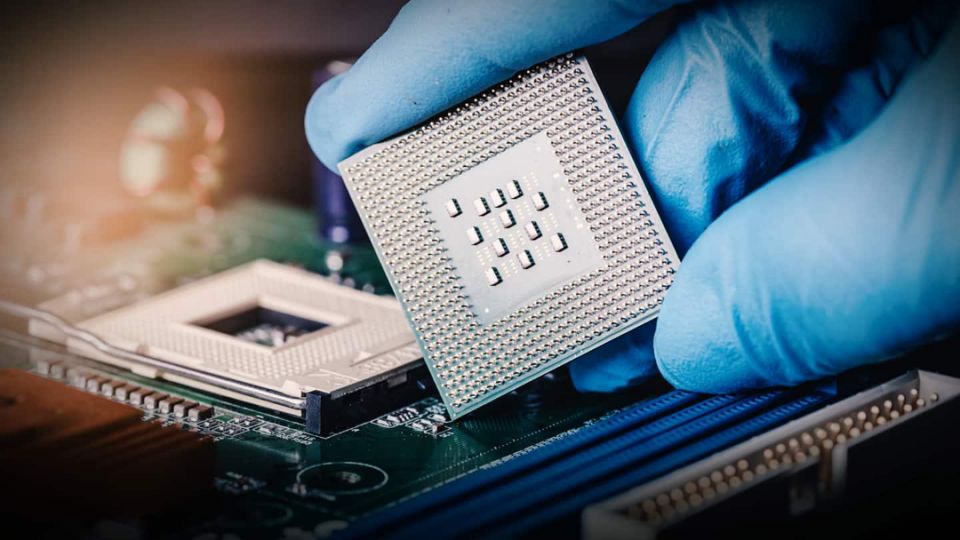

Due to the shortage of chips, the business didn’t go down for semiconductor companies alone but also for big computer and smartphone companies. These small chips designed by the semiconductor industry powers the super fast and efficient computers or smartphones that make our life better. Though the range of chips designed by any company varies greatly with price, this display driver is the one that is putting the entire silicon industry in jeopardy.

Shortage of Display Drivers

A display driver is one of the many chips used in electronic gadgets. The sole purpose of this driver is to send necessary information or a set of instructions required for illuminating your mobile screen or laptop or any navigation device. Now, the main problem that has arisen in the semiconductor industry and beyond is that there aren’t enough display drivers to suffice the demand. The production units are overwhelming as the firms cannot meet the demand which on the other hand is causing the hike of price.

The shortage of display drivers in the market has also increased the cost for liquid crystal display panels as those drivers are essential to building the same. And, spiking prices of these display panels are affecting the manufacturer of laptops, cars, televisions, airplanes, and high-end refrigerators. Even if a company has all the other necessary parts for building a product it will remain incomplete without the display driver. So, the company’s relying on a source of display drivers has its hands tight.

Situation getting Worse

Along with the global shortage of display drivers, power management chips are also lagging in production. Many automobile industries like Ford, Nissan, and Volkswagen have started scaling back their production but it is very tough to make up for the lost revenue during the pandemic. And, keeping aside the consequences of the pandemic that has caused the shortage of supply in the first place, many other unfortunate incidents are also taking place. For example, a rare winter storm in Texas has caused damage to US productions and a fire in Japan led to the shutting down of a facility for a month.

The imbalance that has been caused by one thing has led to a series of harsh events and it is a tough job to establish balance. Taiwan Semiconductor Manufacturing Co has said that though they are running the plants at full capacity still they cannot meet the demand. Jordan Wu, co-founder, and CEO of Himax Technologies said that “every application is short of chips” and he hasn’t witnessed anything like this in the past 20 years.

The Origin of the Crisis

The main origin of the crisis and how the situation eventually evolved is explained by Jordan Wu in a very elaborate manner. First of all, when the pandemic started with people stuck inside the house an understandable miscalculation took place. Major industries tried to predict consumer behavior on the basis of the financial crisis model. But what we witnessed was the demand for good laptops, mobiles, game consoles, and other gadgets started increasing as the lockdown started extending.

The main reason was people started working remotely and education was also shifted to an online platform. At this time the display drivers didn’t face any shortage as the automobile industries got into a long pause as people didn’t step out of their house. So, the suppliers stopped shipping chips to the automobile industry. A few months back when people again started stepping out and resuming normal life they preferred traveling in personal cars rather than public transport. This led to the sudden demand for display drivers as the demand for other electronic gadgets didn’t go down.

So, now even if the company’s push all their employees and production units to their fullest, demands cannot be met. Since the demand has hiked and there is a shortage in supply prices of many electronics are increasing. For example, the price of 50-inch LCD television doubled between January and March. With this ongoing situation, Jordan said, “We have not reached a position where we can see the light at the end of the tunnel.”

Annasha Dey is an NIT student, who apart from studying engineering is also a content writer. She has a great interest in photography, writing, reading novels, and travelling as well. She is a foodie who loves socializing and hanging out with her friends. She is also a trained Kathak dancer and a big fashion enthusiast. Dey also loves watching TV series, which includes F.R.I.E.N.D.S. and Big Bang Theory. To be a better writer she prefers to read more