E-Commerce Firm Udaan Raises $340 Million Ahead of Planned IPO

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

I am a student pursuing my bachelor’s in information technology. I have a interest in writing so, I am working a freelance content writer because I enjoy writing. I also write poetries. I believe in the quote by anne frank “paper has more patience than person

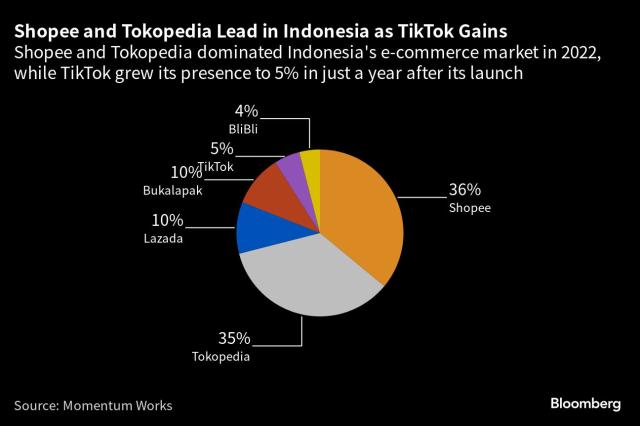

In a surprising turn of events, TikTok, the wildly popular Chinese-owned social media platform, is facing a formidable obstacle in its quest for e-commerce dominance as a groundswell of regulatory backlash grows globally.

The latest blow comes from Indonesia, Southeast Asia’s retail giant, where sweeping regulations have been implemented, forcing TikTok to split payments from shopping—a move that could impede its thriving e-commerce initiatives. The Indonesian Minister of Cooperatives and Small and Medium Enterprises, Teten Masduki, has emerged as a vocal critic, expressing concerns about TikTok squeezing local players. The new regulations prohibit social media companies from handling direct payments for online purchases, and TikTok, with its TikTok Shop, is the only platform currently doing so. This separation poses a significant challenge for TikTok, forcing it to reconsider its e-commerce strategy in Indonesia.

The regulations have triggered a ripple effect in the market, benefiting local players like GoTo and Sea, while potentially chilling the entire online shopping arena. The ban on direct payments could alienate foreign firms and investors, adding to concerns about protectionist measures in various industries.

TikTok has pushed back against the regulations, arguing that separating social media and e-commerce stifles innovation and adversely affects millions of merchants and consumers who rely on the platform for their livelihoods. The company faces the dilemma of either creating a separate app for payments, potentially diminishing its user experience or risk having its business shut down in Indonesia.

Also Read: From Unicorns to Camels: How AI Startups Transcend The Divide in Tech Investment

The conflict with Indonesian authorities marks a stark contrast to the optimism expressed just a few months ago when TikTok’s CEO promised significant investments in Southeast Asia. The regulatory challenges in Indonesia may also set a precedent for other countries in the region to scrutinize TikTok’s influence in their e-commerce markets.

As TikTok navigates this regulatory minefield, it faces not only potential scrutiny in the US, Europe, and India but also the challenge of finding a structure that satisfies authorities while allowing for continued growth. The outcome of this battle will have implications not only for TikTok’s ambitious e-commerce plans but also for the broader landscape of social media and online shopping worldwide.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.

Shopee, a Singapore-based e-commerce site that only launched in India in December 2021, has opted to leave the nation. Shopee’s official rationale, which is controlled by NYSE-listed Sea Ltd, is causing worldwide sentiment to shift.

“In light of global market uncertainty, we have chosen to close risks of our early-stage Shopee India endeavour,” the company stated in a statement. Trade organisations led by Praveen Khandelwal, as well as domestic social commerce start-ups, have been vocal in their opposition to the e-commerce platform.

Source: www.business-standard.com

They claimed it was a back-door infiltration by Tencent, a Chinese corporation, in blatant contravention of FDI guidelines. Shopee recently received relief from the Competition Commission of India (CCI), which dismissed a complaint filed against the company for exploitative pricing.

To add to the troubles, Sea Ltd has been in the middle of a tempest because it also controls the popular gaming software ‘Free Fire,’ which was recently banned by the Centre, along with numerous other Chinese apps.

Shopee, on the other hand, scored a huge victory when the CCI dismissed a petition brought by Khandelwal citing “predatory pricing with the intent of destroying conventional and small-scale businesses in the country.”

Khandelwal, who is also the secretary-general of the Confederation of All India Traders (CAIT), said he intends to appeal the CCI verdict to the National Company Law Appellate Tribunal (NCLAT).

Shopee had allegedly broken FDI restrictions since Tencent owned a significant stake in the Sea Group, according to the trade body. It further stated that the e-commerce platform entered the country through a complicated backdoor.

In its March 3 judgment, the CCI stated that it does not detect any prima facie evidence of Shopee’s violation of provisions 3 and 4 of the Competition Act. It was suggested that Shopee was a newcomer to a market that already had a plethora of e-commerce firms.

According to insiders, Shopee, which employs over 300 people, would provide them three months’ pay as a separation package and will also try to place them in other companies.

It would also provide assistance to sellers until the end of May to remedy any concerns, particularly with transactions.

They also mentioned that the company has shut down operations in France and would now concentrate solely on becoming profitable by 2025, rather than expanding into new areas.

Sea Group has made repeated attempts to reaffirm its status as a Singaporean firm. It has made it plain that Tencent does not have a claim to a board seat. Tencent now owns an 18% stock stake in Sea Ltd.

Sea Ltd founder Forrest Li would possess 57 percent of voting power, up from 52 percent previously, according to the company’s articles of association, which were approved during an annual general meeting (AGM) last month.

Despite having only an 8% stock stake, this is the case. As a result, he effectively has complete influence over the management and the Sea Board. Li was born in Singapore and is a Singaporean citizen.

Tencent’s stake in Sea Ltd has gradually dwindled since it originally invested in the company in 2010. According to Sea’s AGM meeting notice, it now has less than a 10% voting share.

The government’s crackdown on Chinese apps included the abrupt ban on Free Fire. Singapore’s ministry of trade and industry reacted quickly, saying this week that it hoped the restriction will be lifted “as soon as possible.”

According to media sources, the ministry had addressed the Centre a week before to inquire whether the ban was “deliberate” and why it had been imposed, considering that Sea is based in Singapore.

According to sources, the Singapore government is still in talks with the Indian government, but no solution to the disputed ban has been reached.

Artificial Intelligence has picked up tremendously over the last few decades, becoming an integral part of the digital world. Several Indian AI start-ups have been able to make a name for themselves in this highly competitive tech space. The market comprises several niches including, retail, computer vision, image processing, and automation. One particular area wherein AI has tremendous scope, which has not fully materialised yet is in improving e-commerce platforms. CustomerGlu is a company hoping to change all that, by revolutionising the way eCommerce businesses run offers that save money while converting more using AI. Here’s a look at what the company does, and how it has quickly grown to become a leader in the space.

The company, formerly known as Marax.AI burst into the scene with their SaaS platform named Mars in 2019. The tool was the first of its kind, helping businesses optimise and personalise their discounting budgets. Using Artificial Intelligence, the platform helped companies run the most optimised discount campaigns for their products. It also used a privacy-first model, assisting companies in reaching out to their target audience across niches and devices. The tool nudged customers into completing a transaction or purchase by providing them with the right discount rate based on a budget.

The Mars tool utilised deep reinforcement learning principles to recommend and allocate the right discount rate for different users. Furthermore, the software allowed companies to improve their overall marketing, purchasing, and discount experience for users. Also, it did all this without intruding or invading user privacy, making it the perfect tool to reach out to larger audiences. The AI engine monitors data points from the user’s cycle, studying their interactions and behaviour. It then gains an understanding of their intent and engages them through a multistep recommendation process – while considering the cost control constraints for the business. The product aims to help e-Commerce companies improve their net revenues while saving money. CustomerGlu does that by allowing companies to do the following:

The company now uses Microsoft’s Azure platform to run its SaaS platform which enables it to provide customers with the most competitive prices. CustomerGlu received a grant of $120,000 in credits as they are a part of Microsoft for Startups initiative.

The company came to be in 2016, intending to help online businesses solve issues they had related to churn rates. Since then, the company has grown tremendously, aiding the likes of Rapido in optimising their discount experience. The initial team consisted of Prateek Gupta, Raman Shrivastava, and Sumant Subrahamanya. The team has raised their seed round from the likes of Amit Singhal(Former Head of Google Search), SmartStart, and Artesian.VC. The Bangalore-based offer marketing and AI-powered SaaS start-up also has an office in Palo Alto, California. The main mission of the company is to help businesses improve their net revenues while reducing the cost per transaction. By offering users personalised & optimized offers and discounts, the tool helps eCommerce businesses become more profitable.

Marax.AI incubated at a start-up accelerator and seed fund named Axilor. Kris Gopalakrishnan and SD Shibulal, who co-founded Infosys were the brains behind Axilor. The rise in the importance of applied reinforcement learning in marketing to connect analytics with automated actions at the segment of one is what pushed the founders to start something like Mars, which helps companies improve profits on every transaction. The tool solves this problem by contextualizing the offers for higher conversions while reducing the cost per transaction.

In fact, the use of the Mars tool helped DailyNinja(now acquired by BigBasket) reduce churn by around 17%. CustomerGlu is currently in use by a curated set of early adopters like a preventive healthcare app GOQii(Mumbai) to improve net revenue by 10-30%, and cutting costs by 50-77%. Mumbai-based cosmetics e-commerce company Purplle and Jakarta-based delivery service named Sealog are beginning to use the platform.

The company has also raised funds from Amit Singhal(Former Head of Google Search), SmartStart, and Artesian.VC, and are in talks to raise their next round. They also plan on improving their ML and AI model and want to expand their team to scale their company to broader enterprise markets. The firm also receives support and business advice from PK Gulati, who is the Chairman Emeritus and Founder of the TiE Dubai Chapter and Dr. Srinivas Padmanabhuni, who has a PhD. in AI from the University of Alberta, assists the team in improving the design of their Reinforcement Learning engine.

The four-year-old start-up recently repackaged their offerings and launched under the name of CustomerGlu in March 2020. Since the company’s primary aim is to help e-commerce players improve net revenues while reducing the cost per transaction, the new name seems to ‘stick’ well.

CustomerGlu takes care of both budgetary constraints and retention goals. By striking the right balance between optimizing profitability and making offers contextual, the company has proven to be a massive success. By 2021, experts predict that over 2.5 Trillion transactions will occur through mobile devices bringing in revenue worth more than $3 Trillion. CustomerGlu aims to help businesses improve their margins by 10-30% leading to billions of dollars in profit. It will be interesting to see how the company expands, reaching out to more businesses, and helping them give their customers exactly what they need!

The COVID-19 pandemic has forced several businesses to focus on digital growth and expansion. Many brick-and-mortar stores and retail outlets are now taking their business online, and foraying into the e-commerce industry. The Indian government’s push for “Vocal for Local” encourages the sale of Indian products and brands. Therefore, Indian companies now have an opportunity to pledge their support for local industries and accelerate the initiative of Atmanirbhar Bharat, or Self-reliant India. CustomerGlu can work with such e-commerce companies and help them with improving conversions and boosting their ROIs.

By using a plethora of strategies and campaigns like Cart Discounts, Product discount recommendations, Reward, and Activity UI programs the company helps companies drive their profitability.

Being a cinephile with a love for all things outdoorsy, Athulya never misses a chance to chase inspiring stories or poke fun at things, even when the subject is herself. Currently pursuing a degree in mechanical engineering, she is someone innately interested in technical and scientific research. Music reviews and op-eds define her as they allow her to explore different perspectives. Though sometimes she thinks she makes more sense playing the guitar than she does while writing.

Sometimes simple ideas give birth to game-changing businesses. Like a leading payment start-up Dwolla, based in Des Moines that is the product of a simple idea. The idea was related to money transfer. Founder thought it should be simple, speedy, and affordable to all, and as a result, they started a platform called Dwolla. Presently, it is the US’ only e-commerce Company, provides mobile payment networks and online payment systems. It deals with moving money that is affordable yet, simple. Well, we know that dozens of platforms are available for money transfer. But, with the unique idea of Ben Milne and Shane Neuerburg, Dwolla stands out from others. Also, many other businesses chose and succeed with Dwolla as it is customer-centric and its several other features are just great. To take the progress further, recently on 30 March 2020, the firm appointed Brady Harris as a new CEO of the company.

Any company is the product of ideas, dedication, and determination of founders. However, the further policies of them build a strong foundation for the company, and help in exploring the business. Dwolla is a perfect example of it. Its foundation is based on Ben Milne and Shane Neuerburg’s idea of moving money in a faster, simpler, and affordable way. In 2008, they set up Dwolla and made the money moving faster, simpler, and affordable than before.

He is the originator and CEO of the company. Under his policies, Dwolla raised a huge investment of approximately 22 million dollars for further exploration of the company. Ben helped to acquire investors like Union Square Ventures, and Andreessen Horowitz. Also, under his tenure, Dwolla honored as one of the world’s “50 Most Innovative Companies of 2014” by Fast Company.

As well, Milne honored as one of Forbes’ “Disruptors of the Year”. Additionally, he has appeared on an annual 30 under 30 collections of Inc. Magazine, appeared on The TODAY Show, and Bloomberg TV. For his work, he named in the list, “Innovators Under 35” by MIT Technology Review in 2013.

In 2008, he helped in the establishment of Dwolla as well as served as CTO. Apart from that, he is the advisor at Safe Talpa from 2019. Coming to his education, he attended the University of North Dakota for studying computer science. Today the idea of Shane and his co-founder fellow Ben enabled the money transfer with very low transaction costs, faster service, and a feasible approach.

He has 20+ years of experience in leadership in the e-commerce sector. Earlier, Harris served at Payscape as a president.

In 2008, it is set up and earlier the firm provided local services especially in Lowa. That time, only two employees handled all work of the firm. The actual start of Dwolla is considered in 2010 when it was launched in the US. Earlier, services provided to a few small banks, shops, and retailers. After one year, the firm acquired 20000 users and also, the number of employees increased to 15. Only in the first week afterward, it successfully processed 1 million dollars.

It is an e-commerce firm that provides services related to online and mobile payments. Its White label service is constituted of APIs and these are expanded to include instant bank authorizations. In 2011, Dwolla improved its service with Fisync integration and enabled instantaneous transactions which it discontinued in 2017. Also, it has eleven financial firms signed on that provide access to many potential customers (600000 approx).

Lowa based Government authorities use the Dwolla platform as payment methods. In fact, Dwolla is added to the systems of the US Treasury Department’s Bureau of Fiscal for dealing with all kinds of electronics payments.

Four years back, in 2016, Dwolla had been accused of inadequate security practices. CFPB charged Dwolla for data security-related issues. As per CFPB, Dwolla didn’t maintain adequate data security practices as mention on the company’s website.

Despite all odds, Dwolla assisted many small to large businesses to achieve their goals. Also, the firm is known for its unique work method. As a matter of fact, you will never find the Dwolla team in one place. They believed in decentralization, and for that prefer building remote offices at various locations.

As per the idea of founders, the firm is successfully enabled the money transfer with lower transaction costs as compared to Credit card and other payment methods. However, it aims to make the platform more feasible for all kinds of a user in the coming years.

Jayshri is an Electronics Engineer, but her passion towards writing made her to be in this field. Apart from content writing, she loves reading, writing and surfing on various topics. In her free time, she likes to watch TV series and news. Sherlock Holmes is her all time favorite show. Jayshri loves cooking various Indian-western dishes.