Alibaba says it does not expect any material impact from the $2.75 billion antitrust fine.

China’s biggest business conglomerate, Alibaba Group is not expecting any material impact in business and from merchants, said Daniel Zhang, CEO of the company. Alibaba Group was charged a fine of $2.75 billion for its powerful market dominance in the nation. The company is going through a giant turmoil and disturbance with the Chinese government since last year.

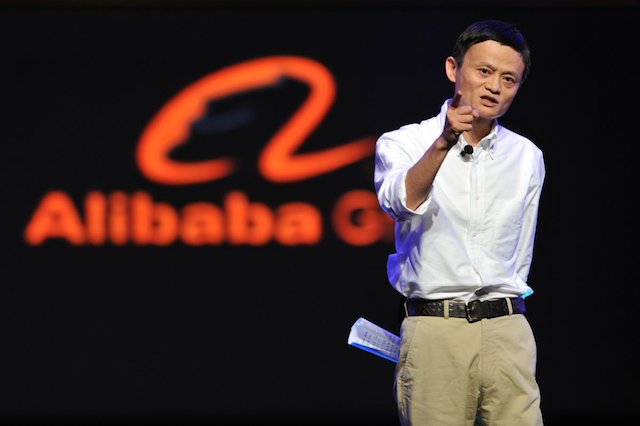

In October 2020, Alibaba Group’s founder Jack Ma openly criticized the Chinese regulatory system. And since then Alibaba Group has been put under strict scrutiny and faced antitrust charges. Alibaba Group has significantly improved the economic system of China through its growing and flourishing business, but the open criticism against the Chinese government is coming with a heavy price.

New Initiatives by Alibaba

Since the company has gone through strict investigations since last year, the regulatory authority will have a strong vigilance. Apart from paying the $2.75 billion antitrust fine, the company is introducing new measures to lower the entry barriers and business costs that are constantly faced by any existing or new merchants on its platform. High cost for new business is an obstacle that needs to be softened to get them a better start and opportunity. Zhang revealed the measures to be taken to lower business costs for merchants in an online conference.

Alibaba’s executives have made a statement that though the company has paid a huge amount of new antitrust fine and that new regulatory measures are to be followed by the company, it believes that the company has overall support from the government (Reuters). Joe Tsai, executive vice-chairman of Alibaba Group said that the government is affirmative of the business model of Alibaba.

The company executives further said that they don’t have any fundamental flaw with their business model as a platform company. The new measures will hopefully bring the turbulence between Alibaba group and the Chinese government into balance. But, it is also a major concern if anyone else criticizes the Chinese regulatory system has to go through the same strict scrutiny.

Shares Bounce

Alibaba’s share has been going down and lagging behind the overall emerging economy for some time in the past. Everbright Sun Hung Kai analyst Kenny Ng has said that now that Alibaba group is paying the penalty fee the uncertainty faced by Alibaba Group in the market will reduce. The antitrust fine along with the regulatory measures that are imposed on the company is expected to bring back Alibaba’s stock price and it will once again regain control in the market.

The antitrust fine that has been enforced on Alibaba Group is one of the highest ever antitrust penalties not only in China but across the globe. Along with the $2.75 billion penalties, the State Administration for Market Regulation (SAMR) has ordered the company to make thorough rectification in order to strengthen internal compliance and protect consumer rights (Reuters). Big conglomerates like Alibaba Group often face criticism both from the government and the public due to establishing a great amount of control in the market.

Another similar example is the Australian government enforcing a law that made Facebook and Google make paid deals with local media companies of Australia. On the bright side, the government is trying to support the local media companies and in the case of Alibaba, consumer rights and internal compliance.

The new measures will likely reduce the revenue growth of Alibaba as a further expansion in the market share will be restricted. Alibaba will also face reduced profit margins in order to upgrade products and services. The company has also constrained the merchants to sell through any other platforms since 2015. This violates China’s anti-monopoly law as the free circulation of goods is hindered.

Exclusivity Issues

Alibaba will be giving the penalty and along with that, it has accepted to ensure compliance and determination. Tsai has said that apart from reviewing the company’s mergers and acquisitions so far the company doesn’t expect any further investigation. He also mentioned that apart from that he doesn’t know of any other anti-monopoly related investigation.

Annasha Dey is an NIT student, who apart from studying engineering is also a content writer. She has a great interest in photography, writing, reading novels, and travelling as well. She is a foodie who loves socializing and hanging out with her friends. She is also a trained Kathak dancer and a big fashion enthusiast. Dey also loves watching TV series, which includes F.R.I.E.N.D.S. and Big Bang Theory. To be a better writer she prefers to read more