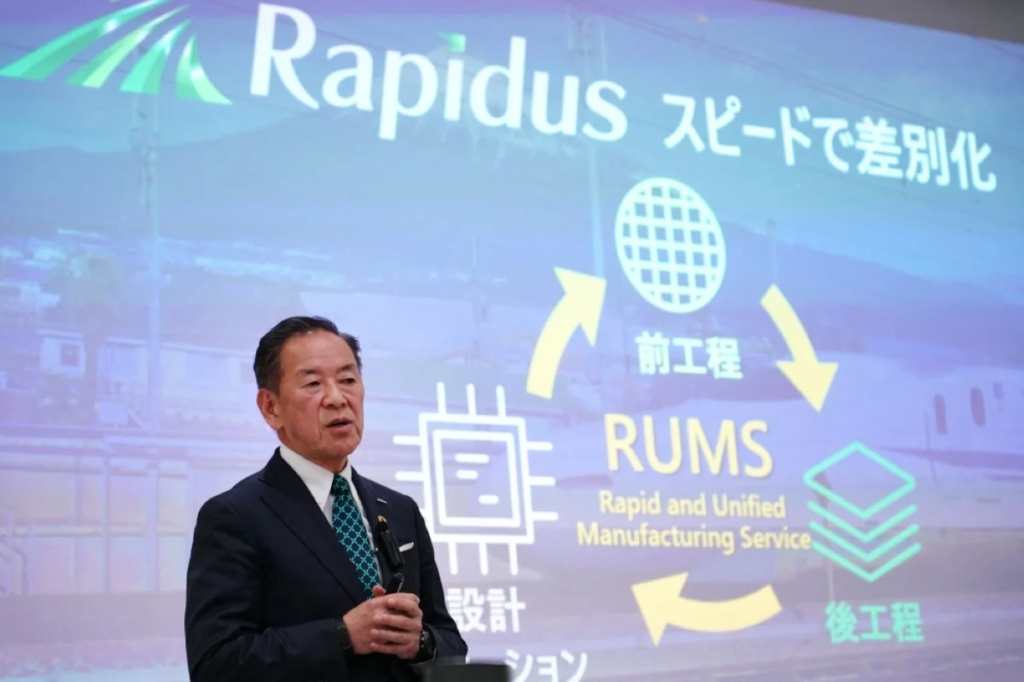

Japan Invests $3.9 Billion in Rapidus Chip Venture to Boost Tech Dominance

Japan has given the green light to allocate a substantial sum of ¥590 billion ($3.9 billion) in subsidies to Rapidus Corp., a semiconductor venture, as part of its ongoing efforts to ramp up chip production capabilities. This significant financial injection is aimed at aiding Rapidus in procuring chipmaking equipment and advancing its back-end chipmaking processes, revealed Economy Minister Ken Saito.

Strategic Investment in Next-Generation Semiconductors

Image Source: kuwaittimes.com

During a regular news conference in Tokyo, Minister Saito emphasized the critical role of next-generation semiconductors in shaping Japan’s industrial landscape and economic growth trajectory. He emphasized the pivotal nature of this fiscal year for Rapidus, underlining the importance of their endeavors in the semiconductor domain.

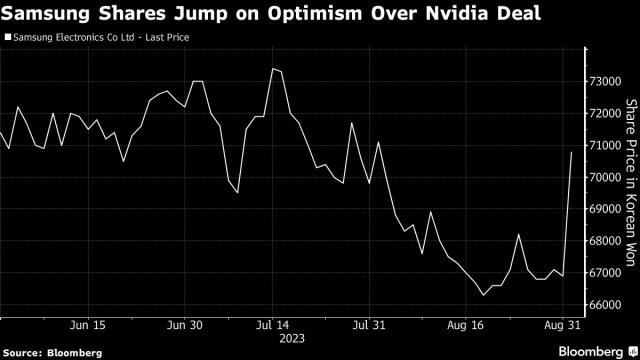

This move has sparked positive market reactions, with Japanese chip equipment makers such as Tokyo Electron Ltd. and Disco Corp. experiencing notable stock price surges in response to the subsidy approval.

Reviving Japan's Semiconductor Sector

This substantial funding forms part of Japan’s broader strategy, allocating around ¥4 trillion over the last three years to revitalize its semiconductor manufacturing capabilities. Prime Minister Fumio Kishida has set ambitious targets, aiming for ¥10 trillion in financial support to chipmakers, in collaboration with the private sector.

Geopolitical tensions and a growing awareness of the strategic importance of semiconductors globally have prompted governments worldwide to bolster domestic semiconductor production. This industry’s significance extends beyond consumer electronics, encompassing critical applications in automotive, energy, defense, and more.

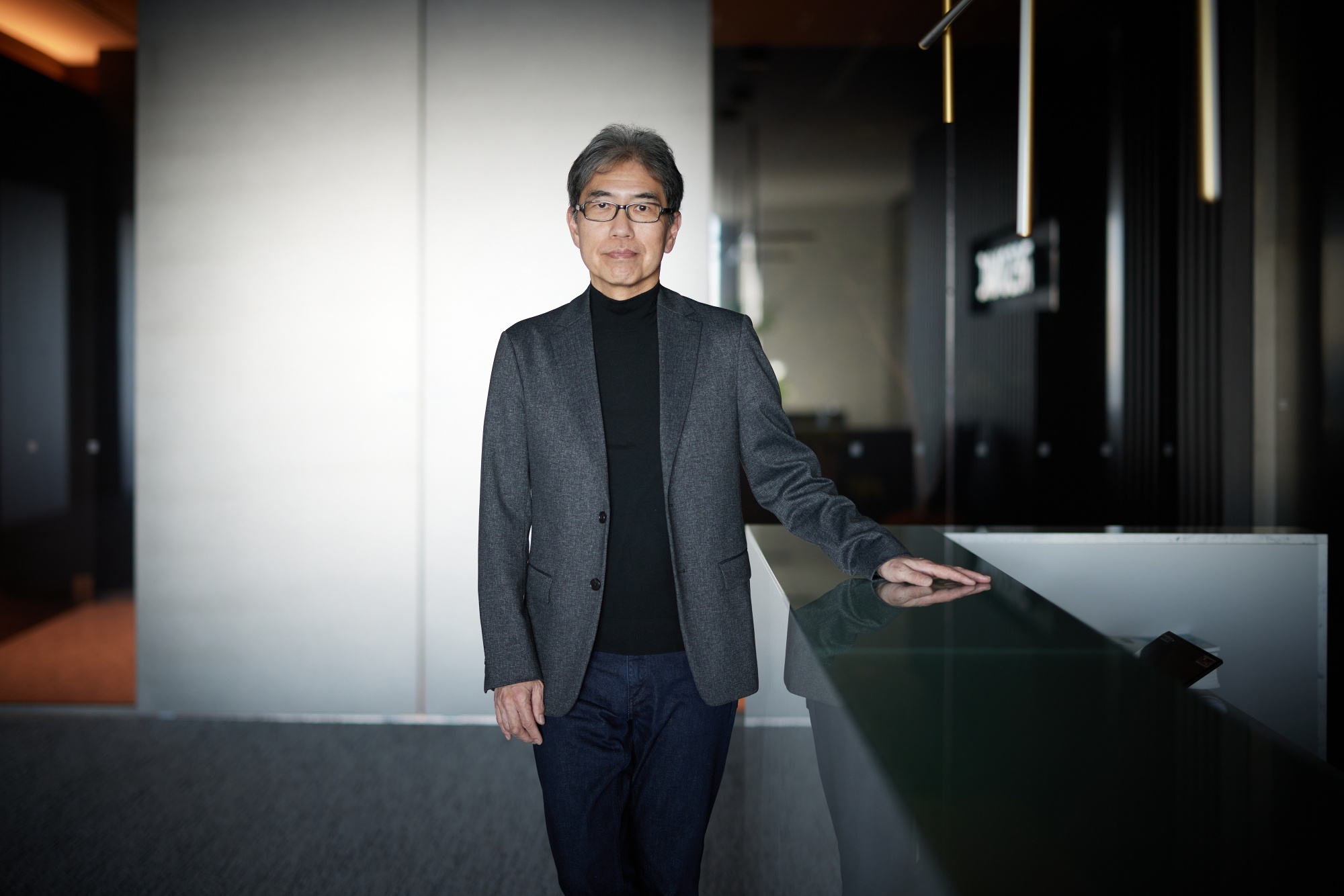

Rapidus’s collaboration with Japanese researchers in nanotechnology and materials underscores the nation’s commitment to narrowing the gap with leading chip manufacturers like Taiwan Semiconductor Manufacturing Co. (TSMC). The aim is to leverage cutting-edge fabrication technology and enhance production efficiency.

Accelerating Innovation and Production Cycles

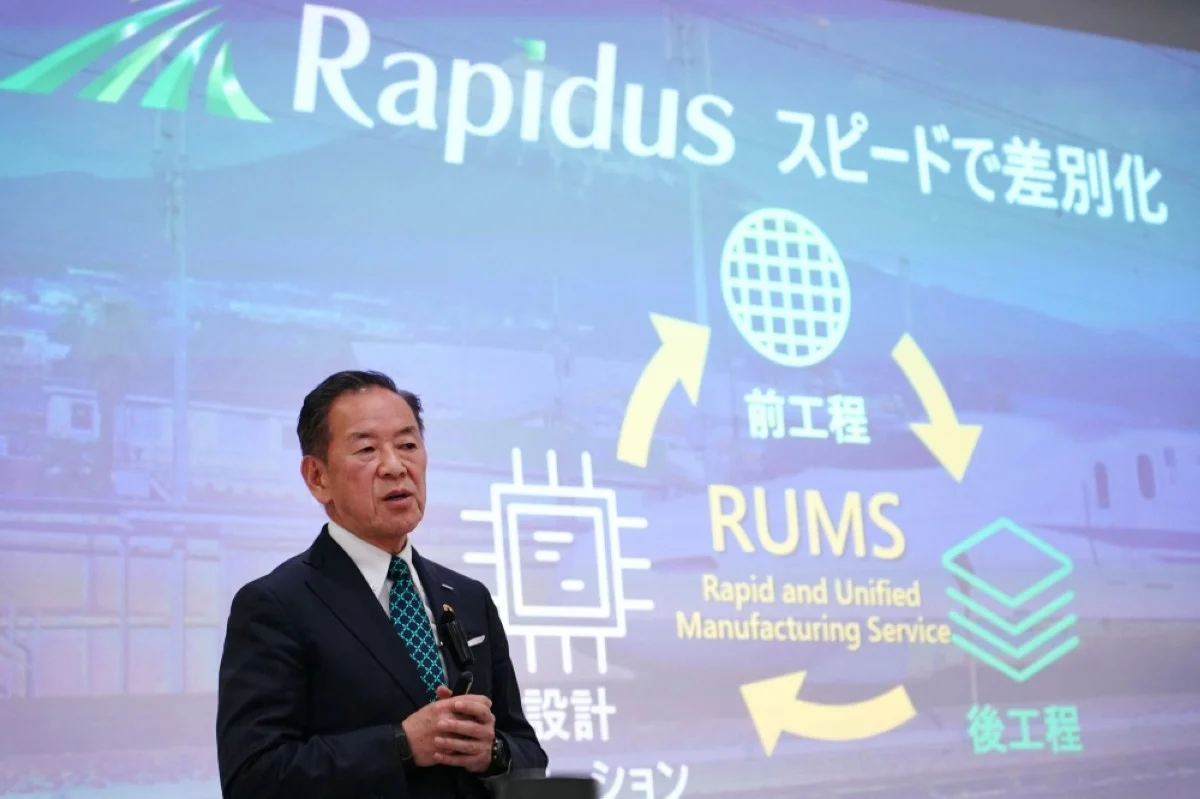

A substantial portion of the newly approved subsidies will be channeled into equipping Rapidus’s pilot line at its Chitose plant, collaborating with IBM Corp. researchers, streamlining production processes, and developing advanced packaging technologies. These initiatives align with Rapidus’s ambitious goal of mass-producing semiconductors using 2-nanometer processes by 2027, while achieving production cycles twice as fast as competitors.

President Atsuyoshi Koike of Rapidus emphasized the critical role these funds play in realizing their vision, highlighting the importance of the pilot line’s development.

Minister Saito also reflected on Japan’s past economic challenges, attributing part of its stagnation to a lack of understanding regarding semiconductor importance. He stressed the foundational role of chips in driving digitalization, decarbonization, and economic security, positioning semiconductors as the cornerstone of Japan’s industries and global economic infrastructure.

I am a law graduate from NLU Lucknow. I have a flair for creative writing and hence in my free time work as a freelance content writer.